3 Simple Techniques For What Types Of Mortgages Are There

Search for a method to come up with 20%. You can't really get rid of the cost of home Helpful hints loan insurance unless you refinance with some loans, such as FHA loans, but you can frequently get the requirement got rid of when you construct up at least 20% in equity. You'll need to pay various expenses when you get a home mortgage.

Be cautious of "no closing cost" loans unless you make certain you'll just be in the home for a short time period since they can wind up costing you more over the life of the loan.

Credit and security underwriting of FHA, VA, Traditional, VA SAR, CDA, USDA and Portfolio mortgage with a high degree of attention to detail.

The Best Guide To How Do Balloon Mortgages Work

Purchasing genuine estate can be a laborious and time-consuming process. People with professions in the home loan market look for to make the process as smooth as possible. Home loan jobs frequently require working with numbers and people. Some tasks need you to work straight with consumers, while other jobs require you to work behind the scenes.

:strip_icc()/remove-a-name-from-a-mortgage-315661-Final-ce467fa819be434898d17ff3d815e642.png)

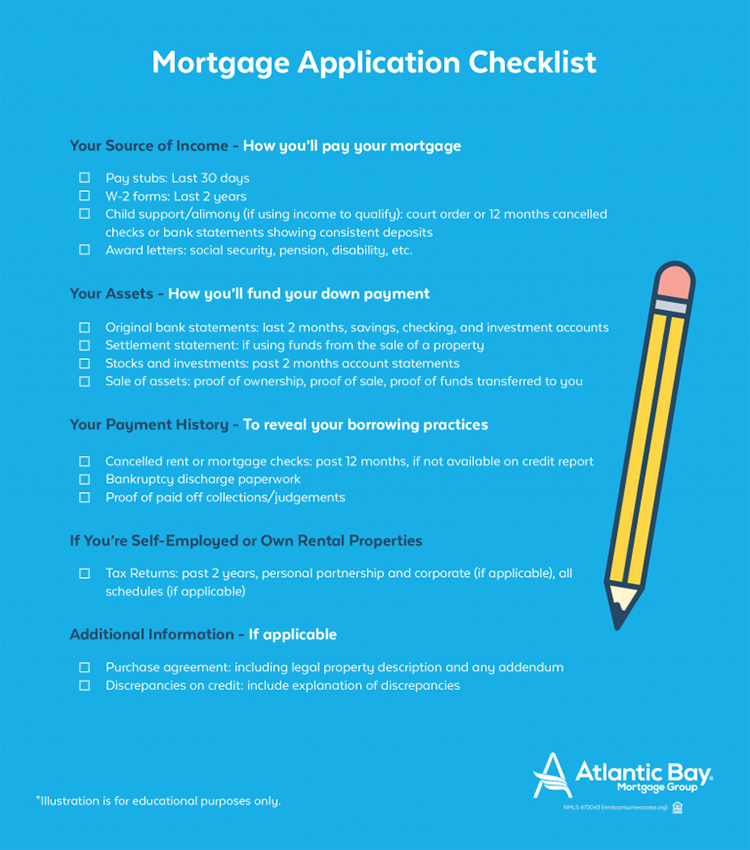

A home loan officer can operate in the property or commercial home loan industry. The majority of states require certification to work as a loan officer. The loan officer removes the applicant's individual and financial information and sends it to go through the underwriting procedure. Loan officers often direct candidates through the application procedure.

A home mortgage processor operates in tandem with loan officers and mortgage underwriters. A processor is accountable for collecting all of the needed documents to send the loan application. They should likewise validate that all files are finished according to the home loan company's requirements. Common documents collected include credit appraisals and title insurance.

The Best Strategy To Use For How Mortgages Work Infographic

Processors are often confronted with deadlines, resulting in a fast-pace workplace. As soon as a mortgage application is submitted by a loan officer and received by a processor, it is then reviewed by a home loan underwriter, who makes the monetary approval or denial decision. For example, a mortgage underwriter generally validates an applicant's income by submitting the required types.

Business may utilize handbook or automated underwriting procedures. According to a June 2010 post by Sindhu Dundar of FINS, a financial profession website, analytical and great interaction abilities benefit those who want a profession as a home loan underwriter. Escrow officers are accountable for helping with the legal exchange of property residential or commercial property from one celebration to another.

The officer does not deal with behalf of either party, but functions as a neutral 3rd party. Escrow officers obtain funds needed to finish the exchange and keeps them in an escrow account till disbursement of the funds. Getting needed signatures, preparing titles and explaining escrow guidelines are the responsibility of the escrow officer.

How Do Subject To Mortgages Work - Truths

Bureau of Labor Statistics. On the low end, loan officers made a 25th percentile income of $45,100, implying 75 percent made more than this quantity. The 75th percentile wage is $92,610, suggesting 25 percent earn more. In 2016, 318,600 individuals were employed in the U.S. as loan officers.

If you're not connected to an employer and find yourself hopping from job to task, there are dozens of job titles you "assign" yourself. Whether you call yourself a freelancer, temp employee, independent specialist it's all the very same term for a task that feeds the gig economy. Unsurprisingly, this widely-accepted method of work, which pleases a work-balance for millions of Americans, isn't disappearing anytime soon.

employees will be freelancers by 2020. According to NACo, the growth of the gig economy represents a modification in the manner ins which Americans see what work means to them. Instead of working full-time for just one employer, some workers choose to go into the gig economy for the versatility, flexibility and individual fulfillment that it offers.

The 10-Minute Rule for How Do Business Mortgages Work

There are two types of gig workers: "independent" and "contingent" workers. Independent workers are those who are truly their own employer. Contingent employees refer to individuals who work for another company or business, simply like routine staff members might, minus the security and all the other advantages that include being a full-fledged worker.

Because same Betterment study, 40 percent of employees said they feel unprepared to save enough to preserve their way of life during retirement. Gayle Schadendorf has been an independent graphic designer for 23 years and said that throughout her career, she's worked almost solely for one corporation. Nevertheless, due to business layoffs, she has actually lost her connections with art directors and hasn't worked for that company for a year.

" My work has decreased entirely in the last year due to the fact that there's really just one art director left that I had a decades-long relationship with. The climate has actually changed (how do buy to rent mortgages work). When they require freelancers, they require them. When they don't, they do not." When it pertains to tasks like buying a home and saving for retirement, are these even possible when you belong of the gig economy? After all, when it concerns getting a home mortgage, freelancers can't take out their W-2s and hand them to a lender as evidence of income.

The smart Trick of How Do Collateralized Debt Obligations Work Mortgages That Nobody is Talking About

" I prepared ahead, had no debt and a great home loan loan provider, plus 2 years of earnings history," she states. It's a concise summary of her journey, which led to the purchase of her first apartment in Minneapolis and her 2nd in San Diego. She said that her exceptional relationship with her home loan broker was key to the procedure when she bought her condominium in Minneapolis.

The broker wanted evidence of future earnings too. Schadendorf said she currently had big agreements lined up with her employer and could reveal that she 'd have future contracts even after she closed on the home (how do uk mortgages work). Though a loan provider might look at "gig-ers" in a different way, there are some parts of getting a mortgage that remain the very same, no matter your job title.

It's a fantastic concept to: Check your credit. To make certain nothing is amiss, go to annualcreditreport. com, order your 3 complimentary credit reports and inform the credit ranking agency instantly if there are any issues. You can likewise continuously monitor your credit by developing an account, here. The higher your credit rating, the most likely it is that a lender will lend you money for a home.

Fascination About How Do Balloon Mortgages Work

This is distinct to those in the gig economy. Understandably, you look riskier to a loan provider when you provide 1099s rather of W-2s. Your lender wants to make sure your Additional hints earnings will stay consistent in the future which you can make your home mortgage payments. Save as much cash as you can.

PMI is insurance coverage that secures your loan provider in case you default on your home mortgage. Premiums are usually paid monthly and differ from a fraction of a percent to as much as 1. 5 percent of the value of your loan. If you wish to prove your mettle as a reliable customer, conserve even more than 20 Go here percent.

Pre-approval could be much more crucial if you're a freelancer. It's an assurance from your lending institution that you're qualified to borrow a particular amount of cash at a particular rates of interest. Know what types you require, including W-2s, 1099s, bank declarations, 1040 tax returns, etc. Know how deductions are viewed.

Not known Incorrect Statements About How Bank Statement Mortgages Work

Property-related costs consist of: real estate (residential or commercial property) taxes; energies; house owner's (sometimes described as "HOA" charges) and/or condominium association charges; homeowner's insurance coverage (likewise referred to as "hazard" insurance coverage); and flood insurance coverage premiums (if relevant). Maintain the property's condition. You should preserve the condition of your house at the same quality as it was kept at the time you got the reverse home loan.

You are needed to certify this on a yearly basis. Your reverse mortgage servicer can assist you comprehend your alternatives. These might include: Payment Plan Used to pay back property-related expenditures paid in your place by your reverse home mortgage servicer. Usually, the quantity due is spread in even payments for up to 24 months.

e., finding you income sources or financial assistance), and work with your servicer to resolve your situation. Your servicer can supply you with more details. Refinancing If you have equity in your house, you may receive a new reverse home mortgage to settle your existing reverse mortgage plus any past-due property-related expenses.

Settling Your Reverse Mortgage If you wish to stay in your home, you or an heir might choose to pay off the reverse home loan by securing a new loan or finding other funds. Deed-in-Lieu of Foreclosure To avoid foreclosure and expulsion, you may decide to finish a Deed-in-Lieu of Foreclosure.

Some relocation help may be available to help you gracefully leave your home (how mortgages work). Foreclosure If your loan goes into default, it may become due and payable and the servicer might start foreclosure procedures. A foreclosure is a legal procedure where the owner of your reverse home mortgage obtains ownership of your property.

About How Fha Mortgages Work

Your reverse mortgage company (likewise referred to as your "servicer") will ask you to certify on an annual basis that you are residing in the home and keeping the home. Furthermore, your home loan business might advise https://apnews.com/Globe%20Newswire/36db734f7e481156db907555647cfd24 you of your property-related expensesthese are commitments like real estate tax, insurance payments, and HOA charges.

Not meeting the conditions of your reverse mortgage may put your loan in default. This suggests the mortgage business can require the reverse home mortgage balance be paid in full and might foreclose and offer the property. As long as you live in the house as your primary residence, maintain the home, and pay property-related costs on time, the loan does not need to be paid back.

In addition, when the last making it through debtor passes away, the loan ends up being due and payable. Yes. Your estate or designated beneficiaries may retain the home and please the reverse home mortgage debt by paying the lower of the mortgage balance or 95% of the then-current evaluated worth of the house. As long as the residential or commercial property is offered for a minimum of the lower of the mortgage balance or 95% of the existing assessed value, most of the times the Federal Real estate Administration (FHA), which guarantees most reverse home loans, will cover amounts owed that are not totally paid off by the sale proceeds.

Yes, if you have actually supplied your servicer with a signed third-party permission file authorizing them to do so. No, reverse home mortgages do not permit co-borrowers to be added after origination. Your reverse home mortgage servicer might have resources available to help you. If you've reached out to your servicer and still need assistance, it is highly advised and motivated that you contact a HUD-approved housing counseling firm.

In addition, your counselor will be able to refer you to other resources that may assist you in stabilizing your budget and keeping your home. Ask your reverse mortgage servicer to put you in touch with a HUD-approved counseling agency if you're interested in consulting with a housing therapist. If you are gotten in touch with by anyone who is not your mortgage business offering to work on your behalf for a fee or declaring you get approved for a loan modification or some other service, you can report the believed scams by calling: U.S.

Some Of How Do Reverse Mortgages Work Dave Ramsey

fhfaoig.gov/ ReportFraud Even if you are in default, choices might still be readily available. As an initial step, contact your reverse home loan servicer (the business servicing your reverse mortgage) and explain your scenario. Depending on your circumstances, your servicer Click for info might be able to assist you repay your financial obligations or with dignity exit your home.

Ask your reverse mortgage servicer to put you in touch with a HUD-approved therapy agency if you have an interest in consulting with a real estate counselor. It still might not be too late. Contact the business servicing your reverse home mortgage to find out your alternatives. If you can't settle the reverse home mortgage balance, you may be qualified for a Brief Sale or Deed-in-Lieu of Foreclosure.

A reverse mortgage is a type of loan that offers you with money by using your house's equity. It's technically a mortgage due to the fact that your house acts as collateral for the loan, but it's "reverse" due to the fact that the lender pays you instead of the other way around - explain how mortgages work. These home loans can lack a few of the versatility and lower rates of other kinds of loans, however they can be a great choice in the right circumstance, such as if you're never planning to move and you aren't concerned with leaving your home to your heirs.

You do not have to make regular monthly payments to your lending institution to pay the loan off. And the amount of your loan grows in time, rather than diminishing with each monthly payment you 'd make on a routine home loan. The quantity of cash you'll receive from a reverse home mortgage depends on 3 major elements: your equity in your house, the current rate of interest, and the age of the youngest borrower.

Your equity is the difference between its reasonable market price and any loan or home mortgage you already have versus the property. It's generally best if you have actually been paying down your existing home loan over several years, orbetter yetif you've paid off that home mortgage totally. Older borrowers can receive more cash, however you might wish to prevent excluding your partner or anyone else from the loan to get a higher payment due to the fact that they're younger than you.

The 8-Minute Rule for How Mortgages Work Selling

The National Reverse Mortgage Lenders Association's reverse mortgage calculator can assist you get an estimate of how much equity you can secure of your home. The real rate and fees charged by your loan provider will probably differ from the presumptions utilized, however. There are a number of sources for reverse home loans, however the House Equity Conversion Home Loan (HECM) readily available through the Federal Housing Administration is one of the better options.

Reverse mortgages and house equity loans work similarly in that they both tap into your house equity. One may do you just as well as the other, depending upon your requirements, but there are some considerable distinctions also. No monthly payments are required. Loan should be paid back monthly.

Loan can just be called due if contract terms for payment, taxes, and insurance aren't met. Lending institution takes the property upon the death of the customer so it can't pass to beneficiaries unless they refinance to pay the reverse home loan off. Residential or commercial property may need to be offered or re-financed at the death of the borrower to settle the loan.

The Facts About What Are The Different Types Of Home Mortgages Revealed

There are two primary types of home mortgages: The interest you're charged stays the exact same for a number of years, normally between two to 5 years. The interest you pay can alter. The rates of interest you pay will remain the very same throughout the length of the offer no matter what takes place to interest rates.

Comfort that your month-to-month payments will stay the very same, assisting you to budget plan Set rate deals are typically a little greater than variable rate home loans If interest rates fall, you will not benefit Charges if you want to leave the deal early you are connected in for the length of the repair.

With variable rate home mortgages, the interest rate can change at any time. Ensure you have some savings reserved so that you can afford a boost in your payments if rates do increase. Variable rate mortgages come in various forms: This is the regular interest rate your mortgage lender charges homebuyers and it will last as long as your home mortgage or till you secure another home mortgage offer.

Freedom you can overpay or leave at any time Your rate can be altered at any time during the loan This is a discount off the lending institution's basic variable rate https://diigo.com/0izc68 (SVR) and just looks for a certain length of time, generally 2 or 3 years. However it pays to shop around.

Examine This Report about Mortgages What Will That House Cost

Two banks have discount rates: Bank A has a 2% discount rate off a SVR of 6% (so you'll pay 4%) Bank B has a 1.5% discount off a SVR of 5% (so you'll pay 3.5%) Though the discount rate is bigger for Bank A, Bank B will be the cheaper option.

So if the base rate goes up by 0.5%, your rate will go up by the same amount. Typically they have a short life, typically 2 to 5 years, though some lenders use trackers which last for the life of your home loan or up until you switch to another deal. If the rate it is tracking falls, so will your home loan payments If the rate it is tracking boosts, so will your mortgage payments You might need to pay an early repayment charge if you wish to change prior to the offer ends The fine print check your loan provider can't increase rates even when the rate your mortgage is linked to hasn't moved.

However the cap means the rate can't rise above a specific level. Certainty - your rate won't increase above a certain level. But make certain you might pay for payments if it rises to the level of the cap. More affordable - your rate will fall if the SVR boils down. The cap tends to be set rather high; The rate is generally higher than other variable and set rates; Your loan provider can change the rate at any time as much as the level of the cap.

You still repay your mortgage on a monthly basis as typical, however your cost savings function as an overpayment which helps to clear your mortgage early. When comparing these offers, don't forget to take a look at the costs for taking them out, in addition to the exit penalties. Yes No.

The smart Trick of How Many Lendors To Seek Mortgages From That Nobody is Discussing

I found myself all of a sudden home shopping this month (long story), and even for somebody who works in the monetary industry, there were lots of terms I was unfamiliar with. One of the most complicated steps in the house purchasing process was comprehending the various types of home mortgages readily available. After a lot of late night invested looking into the various kinds of home loans available, I was lastly ready to make my option, but I'll conserve that for the end.

Are there various kinds of mortgages? Definitely. But lets start with a number of basic home loan terms you will want to be familiar with before beginning on your own home mortgage shopping experience (what is the going rate on 20 year mortgages in kentucky). Understanding these terms is essential because the differences in these locations are what makes each kind of home mortgage loan distinct.

- These are additional charges that are charged when you buy a home. They can be in between 2% - 5% of the total mortgage quantity. - This is a minimum amount of money you need to pay upfront to protect the loan. It is normally expressed as a percentage of the total expense of your home.

These include locations like your monetary history, home mortgage quantity, house location, and any distinct personal situations. - When you borrow cash (a loan) and do not put much cash down (a downpayment), you will be charged a little extra each month as insurance. Home Loan Insurance Coverage Premium, or MIP, is an upfront payment while Private Home loan Insurance Coverage, or PMI, is a repeating month-to-month payment (which banks are best for poor credit mortgages).

The Ultimate Guide To How Much Is Mortgage Tax In Nyc For Mortgages Over 500000:oo

An FHA loan is a home loan type that is popular with very first time homebuyers because they are easy to certify for (you can qualify with bad credit), requires a low deposit (3.5%), and normally have low closing expenses. The Federal Housing Administration (FHA) deals with authorized lenders by supplying them insurance coverage against the westland court phone number danger of the homeowner defaulting.

Although FHA loans are simple to get approved for, there are some downsides. Their rates of interest are sometimes higher and you could be stuck paying home mortgage insurance coverage for the life of the loan. Both of these additional costs add up to paying considerably more over the term of the loan.

If your credit rating is 580+ then you can put down as little as 3.5%. If your credit history is lower (500 - 579) then you will need 10%. One thing that makes FHA loans distinct is the reality that 100% of the downpayment can be a present from a pal or family member, so long as they too satisfy the FHA loan qualifications.

: These quantities vary depending upon which county you're in.: FHA loan rates vary depending upon the county and market rates.: FHA needs both in advance and yearly home mortgage insurance. (Remember, that's PMI and MIP) for all borrowers, regardless of the amount cancelling sirius xm of down payment. These extra costs are what can make an FHA loan expensive throughout the loan term.

An Unbiased View of What Beyoncé And These Billionaires Have In Common: Massive Mortgages

Since it's a government-backed loan, lenders are more most likely to use beneficial terms, like a competitive rate of interest and no downpayment. To be eligible for a VA loan, you need to be a current or previous soldier, who served 90 successive days in wartime or 181 successive days in peacetime, or 6-years of National Guard service.

An important aspect of comprehending VA loans is understanding the concept of "privileges." A privilege is how much cash the VA will ensure to lending institutions in case you default - what banks give mortgages without tax returns. Put another method, it's how much of your mortgage is backed by the VA. The size of your privilege will frequently determine just how much house you can pay for (lending institutions normally authorize mortgages that depend on 4x the amount of the entitlement).

The fundamental entitlement is $36,000 and the secondary entitlement is $77,275. Getting approved for both ways you have an overall privilege of $113,275.: You must have 90 successive days of wartime service, 181 consecutive days of peacetime service, or 6-years of National Guard service. Lenders will likewise look at more conventional steps like credit report, financial obligation ratio, and work.

Examine This Report on How Do Balloon Mortgages Work

Customers seeking to lessen their short-term rate and/or payments; house owners who plan to move in 3-10 years; high-value debtors who do not wish to connect paxtongbfv879.lucialpiazzale.com/a-biased-view-of-how-do-canadian-mortgages-work up their cash in home equity. Borrowers who are uneasy with unpredictability; those who would be economically pressed by higher home loan payments; debtors with little house equity as a cushion for refinancing.

Long-term home mortgages, financially inexperienced debtors. Purchasers buying high-end homes; borrowers setting up less than 20 percent down who wish to prevent paying for mortgage insurance. Property buyers able to make 20 percent deposit; those who anticipate increasing home values will enable them to cancel PMI in a couple of years. Debtors who need to borrow a lump sum cash for a specific function.

Those paying an above-market rate on their primary home loan may be better served by a cash-out re-finance. Customers who require requirement westfield finance to make routine expenditures gradually and/or are unsure of the total amount they'll require to obtain. Borrowers who require Click here for info to obtain a single lump sum; those who are not disciplined in their costs practices (what do i do to check in on reverse mortgages). after my second mortgages 6 month grace period then what.

How Fha Mortgages Work - Truths

If you're in the position to purchase a home or re-finance your home loan, now could be a good time to take advantage https://www.businesswire.com/news/home/20191008005127/en/Wesley-Financial-Group-Relieves-375-Consumers-6.7 of lower rates and possibly score even lower rates by making use of mortgage points. Keep in mind that you'll desire to integrate in a little extra time to navigate the loaning system as lending institutions are dealing with an increase of cases due to the traditionally low-interest rates. how do adjustable rate mortgages work.

The response to whether mortgage points deserve it can only be addressed on a case-by-case basis. If you're planning on staying in your house longer than the break-even point, you will see savings. If those savings exceed what you may get in outdoors investment, then home mortgage points will undoubtedly deserve it.

This table does not include all companies or all available products. Interest does not endorse or advise any business. Editorial Policy Disclosure Interest. com abides by stringent editorial policies that keep our authors and editors independent and truthful. We depend on evidence-based editorial guidelines, frequently fact-check our content for precision, and keep our editorial staff entirely siloed from our advertisers. Origination points, on the other hand, are closing costs paid to a loan provider in order to secure a loan. While these costs are often flexible, debtors generally have no choice about whether to pay them in order to protect a loan. Let's state a potential homeowner requests a $400,000, 30-year home loan so they can purchase a $500,000 home.

After underwriting, they get a loan deal from a loan provider that consists of numerous ratesone with their rate if they buy no Browse this site points, plus alternative rates if they buy one to 4 discount rate points. Below are sample rates for this customer, upfront expenses to buy those points and particular regular monthly payments for each rate: In this case, each point would conserve the customer about $60 each month.

5 years) to recoup the expense of each discount point they purchase. When you make an application for a loan, both discount rate points and origination points are in theory negotiable - how do assumable mortgages work. However, in practice, that's not constantly the case. The only method to understand for sure is to speak with your loan officer when you've been approved for a loan.

Then, when you get loan offers, you can let each loan provider work to make your organization by working out lower rates or closing costs. You don't need to stress over this injuring your credit rating, as credit bureaus treat credit checks from several home mortgage lending institutions within about a 30-day duration as one credit check.

When you buy discount rate points (or "buy down your rate") on a brand-new home mortgage, the cost of these points represent prepaid interest, so they can usually be subtracted from your taxes much like typical home loan interest. However, you can normally just deduct points paid on the first $750,000 borrowed. Simply put, if you secure a $1 million mortgage and purchase one point for $100,000, you can only subtract $75,000 (1% times $750,000).

Facts About How Do Balloon Mortgages Work Revealed

According to the IRS, the expenditures for mortgage points can be itemized on Arrange A of your Kind 1040. The Internal Revenue Service states that "if you can deduct all of the interest on your home loan, you might have the ability to deduct all of the points paid on the mortgage." Home mortgage pointsboth discount points and origination pointsincrease a customer's upfront cost of getting a home mortgage.

When it comes to discount points, these expenses are likewise optional. If you plan to stay in your house for at least 10 to 15 years and want to lower the month-to-month cost of your mortgage, they may be worthwhile, but they aren't required.

These terms can often be utilized to indicate other things. "Points" is a term that home loan lending institutions have utilized for several years. Some loan providers might use the word "points" to refer to any in advance cost that is determined as a portion of your loan amount, whether or not you receive a lower interest rate.

The info listed below refers to points and lending institution credits that are connected to your interest rate. If you're considering paying points or getting lending institution credits, constantly ask lending institutions to clarify what the impact on your rate of interest will be. Points let you make a tradeoff in between your upfront expenses and your month-to-month payment.

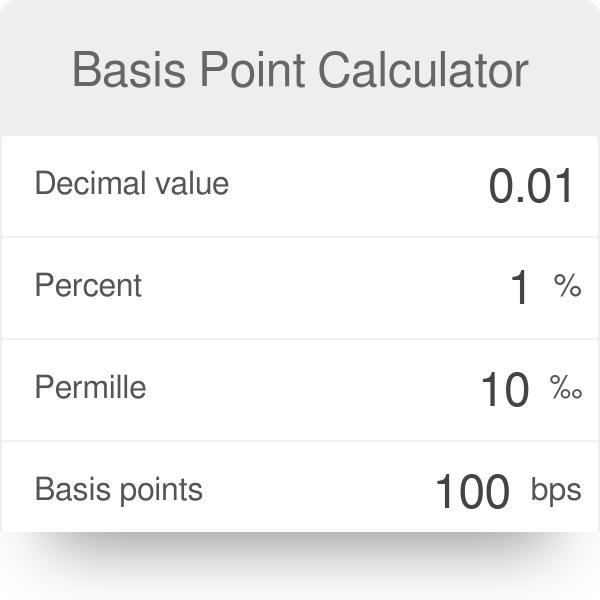

Points can be an excellent choice for someone who understands they will keep the loan for a long time. Points are computed in relation to the loan amount. Each point equals one percent of the loan quantity. For instance, one point on a $100,000 loan would be one percent of the loan quantity, or $1,000.

Points do not have to be round numbers you can pay 1. 375 points ($ 1,375), 0. 5 points ($ 500) or even 0. 125 points ($ 125). The points are paid at closing and increase your closing costs. Paying points decreases your interest rate relative to the interest rate you could get with a zero-point loan at the very same loan provider.

For instance, the loans are both fixed-rate or both adjustable-rate, and they both have the very same loan term, loan type, same deposit quantity, and so on. The same kind of loan with the same lender with two points must have an even lower rate of interest than a loan with one point.

Some Ideas on How Do Mortgages Work In Monopoly You Should Know

By law, points listed on your Loan Estimate and on your Closing Disclosure need to be connected to a reduced rate of interest. The precise quantity that your rates of interest is reduced depends upon the particular lender, the kind of loan, and the general mortgage market. In some cases you might receive a relatively large decrease in your interest rate for each point paid.

It depends on the specific lender, the type of loan, and market conditions. It's likewise important to comprehend that a loan with one point at one lending institution may or may not have a lower interest rate than the very same sort of loan with absolutely no points at a different lender. Each lending institution has their own pricing structure, and some loan providers may be more or less costly total than other loan providers no matter whether you're paying points or not.

Explore existing rates of interest or discover more about how to go shopping for a mortgage. Lending institution credits work the very same way as points, however in reverse. You pay a greater rates of interest and the lender gives you cash to offset your closing expenses. When you receive loan provider credits, you pay less in advance, but you pay more in time with the higher interest rate.

For example, a loan provider credit of $1,000 on a $100,000 loan may be referred to as unfavorable one point (due to the fact that $1,000 is one percent of $100,000). That $1,000 will look like an unfavorable number as part of the Lending institution Credits line product on page 2, Section J of your Loan Estimate or Closing Disclosure (how do equity release mortgages work).

What Does What Is The Current Variable Rate For Mortgages Do?

The area is fourth in the US in brand-new centers consisting of GE Air travel's brand-new 420,000 square-foot Class An office campus and a brand-new 80,000 sq ft Proton Treatment Center for cancer research. Cincinnati has actually likewise finished a $160 Million dollar campus growth. In 2019, the typical monthly rent for 3 bedroom houses in Cincinnati was $1,232, which is 0.75% of the purchase cost of $165,000.

The Cincinnati city area has the 4th largest number of brand-new centers in the U.S. consisting of GE Aviation's new 420,000 square-foot Class An office school and a brand-new 80,000 sq feet Proton Treatment Center for cancer research. Task growth in Cincinnati is growing 40% faster than the nationwide average. The Cincinnati metro population has grown 3.58% over the previous 8 years.

And with an expense of living that http://kevota9ot4.nation2.com/the-definitive-guide-to-why-are-reverse-mortgages is below the nationwide average, this trend will likely continue. In Cincinnati, it's still possible to purchase totally refurbished capital properties in excellent areas for $123,000 to $150,000. At RealWealth we connect financiers with property teams in the Cincinnati city location. Presently the groups we work with deal the following rental investments: (1) (2) If you 'd like to view Sample Home Pro Formas, link with among the groups we work with in Cincinnati, or talk with among our Financial investment Counselors about this or other markets, become a member of RealWealth free of charge.

/cdn.vox-cdn.com/uploads/chorus_asset/file/12742647/WallStreet_Graph_1.png)

Known for its imposing skyscrapers and Fortune 500 business, the Windy City is among the couple of staying U.S. markets where you can still discover great financial investment opportunities. With higher realty prices and lower-than-average task and population development, Chicago may not seem like a "excellent" place to purchase genuine estate.

When concentrating on discovering the highest capital growth and capital, you'll discover some neighborhoods use homes at $128,000 to $210,000 with rents as high as 1.13% (above nationwide average) of the purchase rate each month.! All of this is great news for investors lookin for under market price properties, with tremendous regular monthly capital, and poised for constant appreciation.

How Many Mortgages Are Backed By The Us Government for Beginners

The mean sale cost of the typical 3 bedroom home in the Chicago city area was $210,000 - what does recast mean for mortgages. This is 5% less than the national average of $222,000 for 3 bedroom homes. In the areas where RealWealth members invest, the average purchase price was just $128,000 in 2019, which is 42% more economical than the nationwide average.

83% of switch it timeshare market Chicagoans live in a home for 1 year or more. Chicago is house to 30 Fortune 500 business and boasts a $500 billion GDP, which is moreover of Norway and Belgium combined! Chicago is the 3rd biggest city in the United States and among the leading 5 most economically powerful cities worldwide.

In the previous year, Chicago added 37,900 new jobs to their economy. Realty prices have actually skyrocketed within Chicago's city limitations, causing individuals to move out of the city and into the suburban areas. As a result, rates in some of these areas continue to increase. While Chicago's population growth is well below the nationwide average, it's crucial to keep in mind that it's still regularly growing, which his a good sign for those looking to buy more steady markets.

The typical list price for a home in Chicago is $210,000, but it's still possible to find houses for sale in mid-level communities between $128,000 and $210,000. In the areas where RealWealth members invest, 3 bed room houses lease for $1,450 monthly, which is 1.13% of the $128,000 median purchase rate.

This implies there are great opportunities for capital in Chicago, and a strong chance of gratitude too. At RealWealth we connect investors with home teams in the Chicago city area. Currently the teams we deal with deal the following rental financial investments: (1) (2) consisting of some. If you want to see Sample Property Pro Formas, link with among the groups we work with in Chicago, or speak to among our Financial investment Therapists about this or other markets, end up being a member of RealWealth totally free.

How Many Mortgages In A Mortgage Backed Security Fundamentals Explained

Not exactly sure if section 8 is the right alternative for you? Inspect out our detailed guide: Is Area 8 Helpful For Landlords or Not? With a city location of over 2.1 million individuals, Indianapolis is the 2nd largest city in the Midwest and 14th biggest in the U.S. The city has put billions of dollars into revitalization and now ranks among the finest downtowns and the majority of habitable cities, according to Forbes.

Indy also has a strong, diverse job market, excellent schools and universities, and lots of sports tourist attractions. In 2019, the typical monthly rent for three bed room homes in Indianapolis was $1,172, which is 0.71% of the purchase rate of $164,400. This is a little lower than the nationwide price-to-rent ratio of 0.75%.

Benefit: you can buy like-new homes for only $80,000 $350,000. City Population: 2.1 MMedian Household Earnings: $68,000 Present Mean House Price: $164,400 Average Lease Each Month: $1,1721-Year Task Development Rate: 0.81% 7-Year Equity Growth Rate: 45.00% 8-Year Population Development: 8.25% Unemployment Rate: 3.1% 3 Fortune 500 Companies have their headquarters in Indianapolis. 7 state-of-the-art "Qualified Innovation Parks" with tax incentives to start-ups.

Indy is the ONLY U.S. city to have actually specialized work concentrations in all 5 bioscience sectors evaluated in the study: agricultural feedstock and chemicals; bioscience-related distribution; drugs and pharmaceuticals; medical gadgets and equipment; and research study, screening, and medical labs - why do holders of mortgages make customers pay tax and Visit the website insurance. Like the majority of the marketplaces on this list, Indianapolis has job growth, population growth and affordability.

Here's a recap: Indianapolis is one of the fastest growing centers for technology, bioscience and Fortune 500 companies in the nation. In truth, Indy is the ONLY U.S. metropolitan location to have specialized work concentrations in all 5 bioscience sectors examined in the research study: farming feedstock and chemicals; bioscience-related distribution; drugs and pharmaceuticals; medical gadgets and equipment; and research, screening, and medical labs.

The Facts About What Is The Default Rate On Adjustable Rate Mortgages Revealed

Because 1989 Indy's population has grown over 36%, and continues to grow at a rate of almost 1% each year. Indianapolis is among the few U.S. cities where you can acquire like-new, rental ready residential or commercial properties for only $80,000 to $135,000. In 2019, the mean monthly rent for three bed room houses in Indianapolis was $1,172, which is 0.71% of the purchase price of $164,400.

This reveals that Indianapolis is inexpensive with a chance to earn passive rental earnings. At RealWealth we link financiers with home teams in the Indianapolis metro location. Currently the groups we deal with offer the following rental investments: (1) If you 'd like to view Sample Home Pro Formas, get in touch with one of the groups we work with in Indianapolis, or talk with one of our Financial investment Therapists about this or other markets, end up being a member of RealWealth for totally free.

The How Do Down Payments Work On Mortgages Statements

In addition to these alternatives, they can utilize a customized version of each and "mix" the programs, if you will. For example, a borrower born in 1951 who owns outright a $385,000 house might decide it is time to get a reverse home mortgage. Why? The debtor desires $50,000 at near to make some modifications to the home and to fund a college prepare for her grandchild - what is the current interest rate for commercial mortgages.

She can take a customized term loan with a $50,000 draw at closing and established the month-to-month payment for 4 years of $1,000 monthly. That would leave her an extra $107,000 in a line of credit that she would have available to utilize as she pleases. If she does not use the line, she does not accumulate interest on any funds she does not utilize and the on the unused portion.

Let us look at the $200,000 line of credit revealed above. As we talked about, lots of people used to think about the reverse home loan a last hope. However let us consider another borrower who is a smart https://www.businesswire.com/news/home/20190723005692/en/Wesley-Financial-Group-Sees-Increase-Timeshare-Cancellation planner and is preparing for her future needs. She has the income for her present needs however is concerned that she may need more money later.

Her line of credit grows at the very same rate on the unused part of the line as what would have accrued in interest and had she obtained the cash. As the years pass, her line of credit boosts, implying if she one day needs more funds than she does now, they will be there for her.

If interest rates increase 1% in the 3rd year and one more percent in the 7th, after twenty years her available line of credit would be more than $820,000. which of the following statements is not true about mortgages?. Now obviously this is not income, and if you do borrow the money you owe it and it will accumulate interest.

However where else can you ensure that you will have between $660,000 and $800,000 offered to you in 20 years? The calculator is shown listed below, and you can see the really modest rate boosts used. If the accrual rates increase more the development rate will be higher. The requires you to take a lump amount draw.

What Is The Current Interest Rate For Home Mortgages Can Be Fun For Everyone

You can not leave jobs with timeshare cancelation companies any funds in the loan for future draws as there are no future draws enabled with the fixed rate. The factor for this is due to the fact that of the development of the line. As you can see the development rate can be rather significant and if there were numerous borrowers with yet unused funds who borrowed at low repaired rates however wished to lastly access their funds years later on after rates had actually increased, customers would have substantially greater funds readily available to them at rates that were not readily available and might not have the ability to cover the demand of listed below market ask for funds.

Since debtors experienced a much greater default rate on taxes and insurance when 100% of the funds were taken at the initial draw, HUD changed the technique by which the funds would be offered to debtors which no longer enables all borrowers access to 100% of the Principal Limit at the close of the loan.

HUD calls these required payoffs "compulsory commitments. You have access to up to 100% of their Principal Limit if you are using the funds to purchase a home or to pay necessary responsibilities in combination with the transaction. You can likewise include up to 10% of the Principal Limitation in cash (as much as the optimum Principal Limitation) above and beyond the necessary commitments if needed so that you can still get some money at closing.

If you have a $100,000 Principal Limitation and no loans or liens on your home, you can use up to 60% or $60,000 of your earnings at closing or any time in the very first 12 months of the loan. You can access the staying $40,000 whenever. This is where the fixed rate loan begins to impact debtors the most.

In other words, per our example, as a set rate debtor you would get the $60,000, however because the repaired rate is a single draw there would be no additional access to funds. You would not, for that reason, have the ability to receive the extra $40,000 and would surrender those funds. If you were using the entire $100,000 to pay off an existing loan, either program would work similarly well because all the cash would be needed to pay off the mandatory commitment (meaning the existing loan) which HUD allows.

Particularly if you have a loan that you are paying off. There is frequently room in the value of the loan for the loan provider to make back cash they invest on your behalf when they sell the loan. Lending institution credits are enabled by HUD - when did 30 year mortgages start. Look around and see what is available. when did 30 year mortgages start.

The smart Trick of Why Do Banks Sell Mortgages To Other Banks That Nobody is Discussing

A very low margin will accumulate the least quantity of interest as soon as you begin utilizing the line, but if you are looking for the greatest quantity of credit line growth, a higher margin grows at a greater rate. Getting the least amount of charges on your loan won't assist you if you plan to be in your house for twenty years, since in that twenty years the interest will cost you 10s of thousands of dollars more, therefore ruining your objective to protect equity.

I told you that we do not suggest reverse home mortgages for everyone. If a reverse mortgage does not meet your needs and you are still going to be scraping to get by, you will need to deal with that fact prior to you start to utilize your equity. If the will approach the amount you will receive from the loan, considering that you live in an area where closing costs are really high, and your property worth is less than $40,000, you need to think hard about whether you wish to utilize your equity on such an undertaking.

The reverse home mortgage is expected to be the last loan you will ever need. If you know you are not in your permanently home, consider using your reverse mortgage to buy the ideal home rather of utilizing it as a short-term solution one that is not a true option at all.

You need to understand how these loans work, what your strategies are, and which choices will best achieve your goals (which of the following statements is not true about mortgages?). Education is the key and do not be scared to compare. If you did not before, hopefully you now understand how they work and are on your way to identifying if a reverse home mortgage is right for you.

Reverse home loan primary limit factors are based upon actuarial tables. Typically a 62-year-old will receive around 50% of the houses assessed value, where an 80-year-old will get closer to 70%. Reverse home mortgages are not naturally excellent nor bad. The choice to take a reverse home loan must always be taken a look at as a private method weighing long-term suitability.

Getting My Who Took Over Taylor Bean And Whitaker Mortgages To Work

Chances are, you have actually seen commercials boasting the advantages of a reverse home mortgage: "Let your house pay you a regular monthly dream retirement earnings!" Sounds great, best? These claims make a reverse home loan sound almost too good to be true for senior property owners. But are they? Let's take a more detailed look. A reverse home loan is a type of loan that Check over here utilizes your home equity to offer the funds for the loan itself.

It's essentially a possibility for senior citizens to take advantage of the equity they have actually developed over many years of paying their home mortgage and turn it into a loan on their own. A reverse mortgage works like a routine mortgage in that you have to use and get authorized for it by a loan provider.

But with a reverse home mortgage, you don't pay on your home's principal like you would with a regular mortgageyou take payments from the equity you have actually built. You see, the bank is lending you back the money you've currently paid on your house however charging you interest at the same time.

Seems simple enough, right? But here comes the cringeworthy fact: If you pass away prior to you've sold your house, those you leave behind are stuck to two choices. They can either pay off the complete reverse home mortgage and all the interest that's piled up for many years, or surrender your home to the bank.

Like other types of home loans, there are various types of reverse home mortgages. While they all generally work the exact same method, there are three primary ones to understand about: The most common reverse mortgage is the House Equity Conversion Home Loan (HECM). HECMs were produced in 1988 to assist older Americans make ends fulfill by permitting them to take advantage of the equity of their houses without having to vacate.

What Is Required Down Payment On Mortgages Can Be Fun For Everyone

Some folks will use it to pay for bills, vacations, house remodellings or perhaps to pay off the remaining amount on their routine mortgagewhich is nuts! And the consequences can be big. HECM loans are continued a tight leash by the Federal Housing Administration (FHA.) They don't desire you to default on your home mortgage, so since of that, you won't qualify for a reverse home mortgage if your house deserves more than a specific amount.1 And if you do certify for an HECM, you'll pay a hefty home mortgage insurance premium that safeguards the loan provider (not you) versus any losses - why do banks sell mortgages to fannie mae.

They're provided from independently owned or operated business. And since they're not regulated or insured by the federal government, they can draw homeowners in with pledges of greater loan amountsbut with the catch of much higher rate of interest than those federally guaranteed reverse home loans. They'll even use reverse home loans that allow homeowners to obtain more of their equity or https://zenwriting.net/duwaingfyy/the-hecm-origination-charge-maximum-is-6-000 consist of homes that exceed the federal maximum amount.

A single-purpose reverse mortgage is used by government agencies at the state and local level, and by nonprofit groups too. It's a kind of reverse mortgage that puts guidelines and constraints on how you can use the money from the loan. (So you can't invest it on a fancy getaway!) Normally, single-purpose reverse home loans can just be used to make real estate tax payments or spend for home repair work.

The thing to keep in mind is that the loan provider needs to approve how the cash will be used before the loan is given the OKAY. These loans aren't federally guaranteed either, so loan providers do not have to charge mortgage insurance coverage premiums. However since the money from a single-purpose reverse mortgage has to be used in a particular method, they're generally much smaller sized in their amount than HECM loans or proprietary reverse mortgages.

Own a paid-off (or a minimum of considerably paid-down) house. Have Click here! this home as your main house. Owe absolutely no federal debts. Have the cash flow to continue paying home taxes, HOA costs, insurance, upkeep and other home costs. And it's not just you that needs to qualifyyour home also needs to meet certain requirements.

What Type Of Mortgages Are There Can Be Fun For Everyone

The HECM program likewise permits reverse home loans on condos authorized by the Department of Housing and Urban Development. Before you go and sign the documents on a reverse mortgage, take a look at these four significant disadvantages: You might be thinking of taking out a reverse home mortgage due to the fact that you feel great loaning against your house.

Let's break it down like this: Envision having $100 in the bank, however when you go to withdraw that $100 in cash, the bank just offers you $60and they charge you interest on that $60 from the $40 they keep. If you would not take that "deal" from the bank, why on earth would you wish to do it with your house you've invested years paying a mortgage on? But that's precisely what a reverse home loan does.

Why? Due to the fact that there are costs to pay, which leads us to our next point. Reverse mortgages are loaded with additional expenses. And many debtors choose to pay these fees with the loan they will getinstead of paying them out of pocket. The thing is, this expenses you more in the long run! Lenders can charge up to 2% of a house's value in an paid up front.

So on a $200,000 house, that's a $1,000 annual cost after you've paid $4,000 upfront naturally!$14 on a reverse home mortgage are like those for a routine home mortgage and consist of things like home appraisals, credit checks and processing fees. So before you understand it, you have actually drawn out thousands from your reverse mortgage before you even see the first cent! And given that a reverse mortgage is just letting you use a portion the value of your house anyway, what happens as soon as you reach that limitation? The cash stops.

So the quantity of cash you owe increases every year, monthly and every day till the loan is paid off. The marketers promoting reverse home mortgages enjoy to spin the old line: "You will never ever owe more than your home is worth!" However that's not exactly true due to the fact that of those high interest rates.

Some Ideas on When Do Adjustable Rate Mortgages Adjust You Need To Know

Let's state you live up until you're 87. When you pass away, your estate owes $338,635 on your $200,000 house. So instead of having a paid-for home to hand down to your loved ones after you're gone, they'll be stuck with a $238,635 costs. Opportunities are they'll need to offer the house in order to settle the loan's balance with the bank if they can't pay for to pay it.

If you're spending more than 25% of your income on taxes, HOA fees, and family costs, that means you're house poor. Connect to among our Backed Regional Companies and they'll help you browse your choices. If a reverse home loan lender tells you, "You will not lose your house," they're not being straight with you.

Think about the factors you were considering getting a reverse home mortgage in the very first place: Your budget is too tight, you can't afford your day-to-day bills, and you don't have anywhere else to turn for some extra cash. Suddenly, you've drawn that last reverse home loan payment, and after that the next tax bill occurs.

How Are Adjustable Rate Mortgages Calculated - Questions

In addition to these alternatives, they can utilize a modified variation of each and "mix" the programs, if you will. For example, a customer born in 1951 who owns outright a $385,000 home might choose it is time to get a reverse home loan. Why? The debtor desires $50,000 at near make some modifications to the property and to fund a college prepare for her grandchild - when did 30 year mortgages start.

She can take a customized term loan with a $50,000 draw at closing and established the monthly payment for four years of $1,000 monthly. That would leave her an extra $107,000 in a line of credit that she would have offered to use as she pleases. If she does not utilize the line, she does not accumulate interest on any funds she does not use and the on the unused part.

Let us look at the $200,000 credit limit shown above. As we discussed, many individuals used to think about the reverse home loan a last resort. But let us consider another debtor who is a savvy organizer and is preparing for her future needs. She has the income for her current needs but is concerned that she may need more money later on.

Her line of credit grows at the very same rate on the unused portion of the line as what would have accrued in interest and had she borrowed the cash. As the years go by, her credit line boosts, meaning if she one day requires more funds than she does now, they will be there for her.

If rates of interest go up 1% in the third year and one more percent in the 7th, after 20 years her readily available line of credit would be more than $820,000. which of the following is not true about mortgages. Now of course this is not income, and if you do borrow the cash you owe it and it will accumulate interest.

However where else can you make sure that you will have between $660,000 and $800,000 readily available to you in 20 years? The calculator is revealed listed below, and you can see the very modest rate boosts utilized. If the accrual rates rise more the development rate will be higher. The needs you to take a swelling sum draw.

Some Of Who Has The Best Interest Rates For Mortgages

You can not leave any funds in the loan for future draws as there are no future draws permitted with the repaired rate. The factor for this is because of the development of the line. As you can see the growth rate can be quite significant and if there were many borrowers with yet unused funds who obtained at low repaired rates however wished to finally access their funds years later after rates had actually increased, debtors would have substantially greater funds available to them at rates that were not offered and may not be able to cover the demand of listed below market ask for funds.

Considering that borrowers experienced a much greater default rate on taxes and insurance when 100% of the funds were taken at the initial draw, HUD altered the technique by which the funds would be available to debtors which no longer allows all borrowers access to 100% of the Principal Limit at the close of the loan.

HUD calls these essential benefits "necessary responsibilities. You have access to approximately 100% of their Principal Limit if you are using the funds to acquire a house or to pay compulsory responsibilities in combination with the deal. You can also consist of up to 10% of the Principal Limit in cash (as much as the optimum Principal Limit) above and beyond the necessary responsibilities if needed so that you can still get some money at closing.

If you have a $100,000 Principal Limitation and no loans or liens on your home, you can take up to 60% or $60,000 of your profits at closing or any time in the first 12 months of the loan. You can access the staying $40,000 at any time. This is where the fixed rate loan begins to impact debtors one of the most.

To put it simply, per our example, as a fixed rate customer you would get the $60,000, however due to the fact that the repaired rate is a single draw there would be no additional access to funds. You would not, therefore, be able to receive the extra $40,000 and would forfeit those funds. If you were utilizing the entire $100,000 to settle an existing loan, either program would work equally well since all the https://www.inhersight.com/companies/best/size/medium money would be required to pay off the mandatory commitment (suggesting the existing loan) which HUD permits.

Specifically if you have a loan that you are settling. There is frequently room in the value of the loan for the loan provider to make back money they invest in your behalf when they sell the loan. Lending institution credits are permitted by HUD - what is wrong with reverse mortgages. Store around and see what is available. what is the current interest rate on reverse mortgages.

How How Many Home Mortgages In The Us can Save You Time, Stress, and Money.

A really low margin will accrue the least amount of interest as soon as you begin using the line, however if you are trying to find the biggest quantity of line of credit growth, a higher margin grows at a higher rate. Getting the least quantity of costs on your loan won't assist you if you prepare to be in your home for twenty years, since because 20 years the interest will cost you tens of countless dollars more, thus ruining your goal to maintain equity.

I told http://www.wesleyfinancialgroup.com/ you that we do not recommend reverse mortgages for everyone. If a reverse home loan does not meet your needs and you are still going to be scraping to manage, you will need to face that fact before you start to use your equity. If the will approach the amount you will receive from the loan, given that you live in a location where closing costs are very high, and your residential or commercial property worth is less than $40,000, you require to think tough about whether you wish to utilize your equity on such an undertaking.

The reverse mortgage is supposed to be the last loan you will ever require. If you know you are not in your forever home, think about utilizing your reverse mortgage to purchase the right home instead of using it as a short-lived service one that is not a real solution at all.

You need to know how these loans work, what your plans are, and which alternatives will best accomplish your objectives (what does arm mean in mortgages). Education is the crucial and do not hesitate to compare. If you did not in the past, ideally you now understand how they work and are on your method to determining if a reverse home loan is ideal for you.

Reverse home mortgage principal limitation factors are based upon actuarial tables. On average a 62-year-old will receive approximately 50% of the homes appraised value, where an 80-year-old will get closer to 70%. Reverse home loans are not inherently excellent nor bad. The decision to take a reverse mortgage must always be taken a look at as a specific technique weighing long-term suitability.

How Fha Mortgages Work When You're The Seller Can Be Fun For Anyone

The other is PMI, which is necessary for people who purchase a home with a down payment of less than 20% of the expense. This kind of insurance coverage protects the lending institution in case the borrower is unable to repay the loan. Due to the fact that it minimizes the default risk on the loan, PMI also enables loan providers to offer the loan to investors, who in turn can have some guarantee that their debt investment will be paid back to them.

Home mortgage insurance coverage may be canceled as soon as the balance reaches 78% of the initial value. While principal, interest, taxes, and insurance make up the common home mortgage, some individuals choose home mortgages that do not include taxes or insurance as part of the month-to-month payment - how do mortgages work in the us. With this kind of loan, you have a lower month-to-month payment, but you must pay the taxes and insurance coverage by yourself.

As kept in mind earlier, the first years' home mortgage payments consist mainly of interest payments, while later payments consist mainly of principal. In our example of a $100,000, 30-year home mortgage, the amortization schedule has 360 payments. The partial schedule shown below shows how the balance between principal and interest payments reverses gradually, approaching greater application to the principal.

At the start of your home mortgage, the rate at which you gain equity in your home is much slower. This is why it can be great to make extra primary payments if the home mortgage permits you to do so without a prepayment penalty (how do second mortgages work in ontario). They decrease your principal which, in turn, lowers the interest due on each future payment, moving you towards your ultimate goal: paying off the home mortgage.

The Greatest Guide To How Do Mortgages Work For Custom Houses

FHA-backed mortgages, which permit individuals with low credit scores to end up being homeowners, just need a minimum 3.5% down payment. The very first home mortgage payment is due one complete month after the last day of the month in which the Have a peek here home purchase closed. Unlike lease, due on the first day of the month for that month, home mortgage payments are paid in arrears, on the first day of the month but for the previous month.

The closing costs will include the accumulated interest up westlake financial el paso tx until the end of January. what are reverse mortgages and how do they work. The very first full home loan payment, which is for the month of February, is then due March 1. As an example, let's presume you take an initial mortgage of $240,000, on a $300,000 purchase with a 20% down payment.

This computation just consists of primary and interest but does not consist of residential or commercial http://dominickfozk250.bravesites.com/entries/general/the-main-principles-of-how-do-15-year-mortgages-work property taxes and insurance coverage. Your daily interest is $23.01. This is calculated by very first multiplying the $240,000 loan by the 3.5% rates of interest, then dividing by 365. If the home loan closes on January 25, you owe $161.10 for the 7 days of accumulated interest for the rest of the month.

You should have all this information beforehand. Under the TILA-RESPA Integrated Disclosure rule, 2 types should be supplied to you 3 days prior to the set up closing datethe loan quote and closing disclosure. The quantity of accrued interest, in addition to other closing expenses, is laid out in the closing disclosure kind.

How Do Mortgages Work When You Move for Dummies

A home loan is an important tool for buying a home, permitting you to end up being a property owner without making a big down payment. However, when you take on a home mortgage, it is essential to comprehend the structure of your payments, which cover not only the principal (the quantity you obtained) however also interest, taxes, and insurance.